Product Demand

Oregon’s forest products industry has a long history of innovation and adaption. Changes in demand for forest products and shifting public values have led to periods of painful adjustments but also to new opportunities, increasing efficiencies in production and safer workplaces.

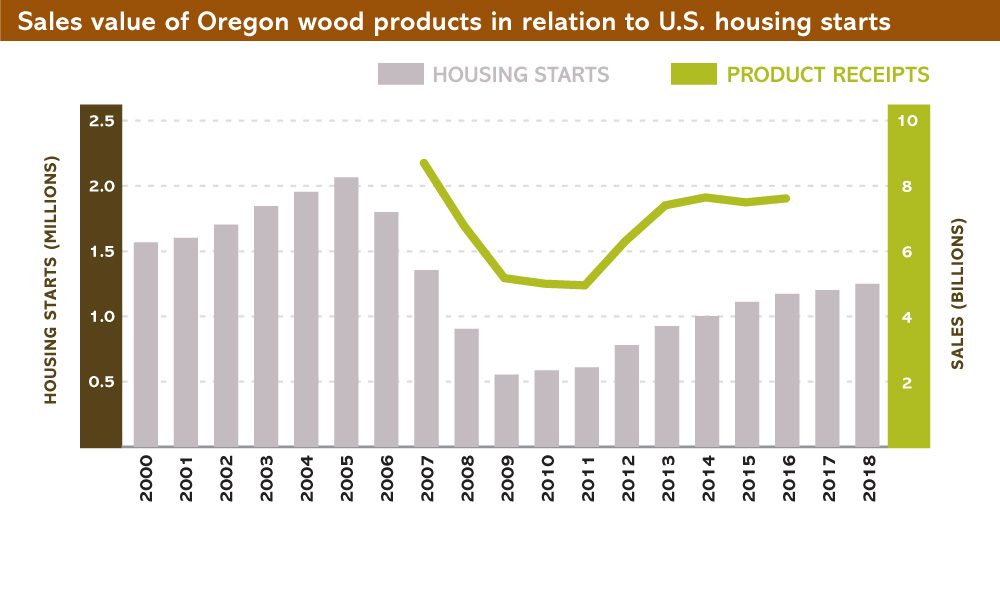

The industry continues to recover from the last recession. Housing construction, a key indicator of wood products demand, is on the rise, and total wood products sales in Oregon are increasing.

In recent years, emerging trends such as the use of engineered mass timber products to construct apartments, condominiums and commercial buildings have also created new markets for Oregon wood products.

U.S. housing starts are up in recent years, but housing repair and remodeling is expected to be a greater source of domestic lumber demand than building new homes. Housing construction is around its highest point since the U.S. housing crisis and recession in 2008, although still below its pre-recession peak. Total spending on commercial construction is also on the rise.

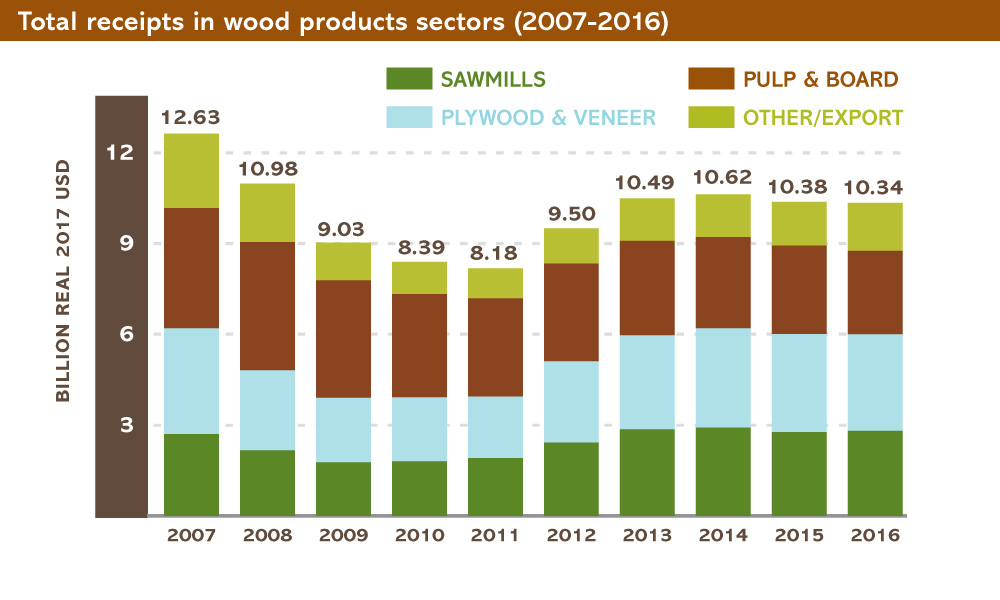

Total wood and paper products sales in Oregon increased from $8.2 billion in 2011 to $10.3 billion in 2016 as the economy recovered from the financial crisis years. While sales from pulp, paper and board facilities decreased from 2010 to 2016, sales from sawmills, plywood and veneer facilities, chipping facilities, and other sectors substantially increased.

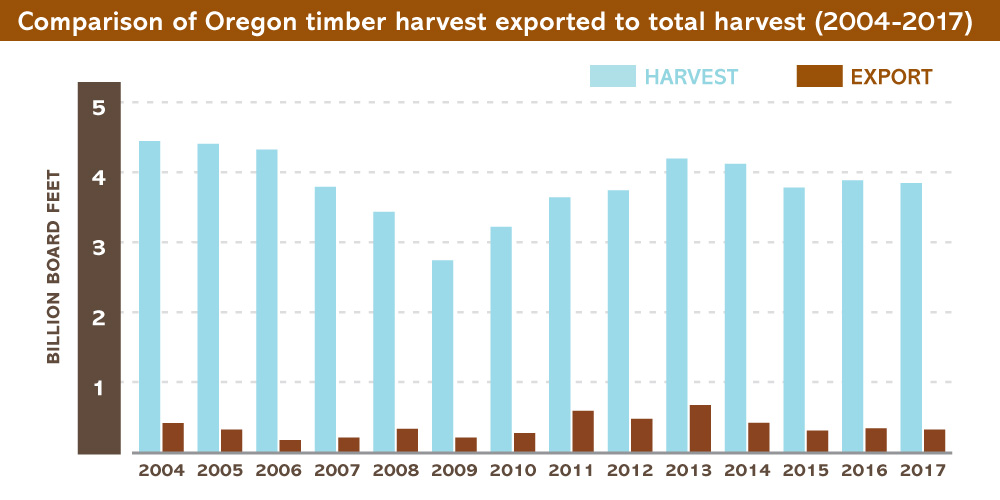

Log exports can be a significant source of revenue for Oregon forest landowners and tend to go up when there is low domestic demand for wood products. After peaking in 2011 to 2013, mainly due to high Chinese demand, log exports have decreased in recent years as the U.S. housing market recovers. In 2017, approximately 9 percent of Oregon’s timber harvest was exported.